2. Income, Budget, and Career Planning

Learning Objectives

- Understand the impact of job choice on overall earnings.

- Develop a household budget.

What Are Your Priorities?

Imagine you’re a high school senior thinking about your next steps. Let’s use the following steps to determine your priorities for your future.

Step 1

List all of your choices.

Step 2

Rank your choices.

Step 3

Select number one from your ranking.

We’ll complete each step one at a time.

First Steps to Income, Budget, and Career Planning

What kind of life do you want to experience in your 30s, 50s, 70s, and beyond? No matter what it is, you can take steps now to make it happen later. When you are young, you are ambitious, energetic, and have many opportunities. But remember, you are also farmers for your own lives. If you want enough food to survive in winter, you need to plant your seeds in spring and work hard through the harvest in fall.

In this chapter, we will talk about income. A primary income component—especially earlier in adulthood—comes from your wages or salary. Your wages are determined by your personality, education, and career choice; if you are paid well, congratulations! However, higher pay never guarantees a more prosperous life. You must create a budget to track your expenses and ensure they are less than your income (most of the time). Therefore, you will have a little extra money each month to save or invest. These are your seeds and will grow your wealth as time passes to help you achieve financial success.

Income: What Is It, and Where Does It Come From?

Income is what is earned or received in a given period.

There are three different ways of earning income

Income and Risk

Your income provides you with living expenses. Therefore, you need to protect your income.

Think about it: How can you protect your income?

- Spread the risk by diversifying sources of income.

- Do not put all your eggs in one basket.

- If your eggs are in several baskets and you put these baskets in many different places, your eggs are protected effectively.

Budget: Where Does Income Go?

- Your income goes to another person or group as payment for an item, service, or other category of costs.

- The outflow of money is called expense.

- For a tenant, rent is an expense.

- For students or parents, tuition is an expense.

- Expenses happen over and over again.

- This is because food, housing, clothing, and so on are used up on a daily basis.

- A budget is a projection of income and expenses over a specified future period of time.

- It includes expected income and expected expenses.

- A budget is helpful to anticipate cash shortages so you can be prepared.

- You can treat a budget as a cash flow statement for a future time period.

- Let’s look at an example of a budget

Table 4A: Example of a household budget: Cash inflows

| Total Cash Inflows | $2,500 | $2,500 |

| Cash Inflows | Actual Amounts Last Month | Expected Amounts This Month |

|---|---|---|

| Disposable (after-tax) income | $2,500 | $2,500 |

| Interest on Deposits | 0 | 0 |

| Dividend payments | 0 | 0 |

Table 4B: Example of a household budget: Cash Outflows

| Total Cash Outflows | $2,100 | $2,800 |

| Cash Outflows | Actual Amounts Last Month | Expected Amounts This Month |

| Rent | $600 | $600 |

| Internet | $50 | $50 |

| Electricity and water | $60 | $60 |

| Cellular | $60 | $60 |

| Groceries | $400 | $400 |

| Health care insurance and expenses | $130 | $430 |

| Clothing | $100 | $100 |

| Car expenses (insurance, maintenance, and gas) | $200 | $500 |

| Recreation | $600 | $600 |

Table 4C: Example of a household budget: Totals

| Actual Amounts Last Month | Expected Amounts This Month | |

| Net Cash Flows | + $300 | – $300 |

What Is a Budget?

Just as you can use a cash flow statement to gauge where you have been in the past and a balance sheet to gauge where you are now, a budget can help you get where you want to go financially.

Income − Expenses

Developing a Budget

Getting Started—Things to Keep In Mind

A budget is usually developed with a specific goal in mind.

For example:

- Cut living expenses

- Increase savings for education or retirement

A budget should be prepared conservatively.

- Underestimate your income

- Overestimate your expenses

Creating a budget requires projecting realistic behavior.

- Your projection comes from your actual past behavior.

- Your financial statements are helpful summaries of your historical reality.

- A budget should constantly be revised to reflect new information (e.g., weekly, monthly, quarterly, annually).

Now, let’s develop a budget!

Developing a Budget Step-by-Step

Move between cards with the next & previous buttons.

Example: Household Budget

Here is an example of a household budget. It groups monthly net income and monthly expenses and then subtracts the expenses from the net income to determine if there is a budget surplus or deficit.

Table 5A: Household Budget Monthly Net Income

| Income source | Amount |

| Total income | $3,100 |

| Salary | $3,000 |

| Interest on deposits | $100 |

Table 5B: Household Budget Monthly Expenses

| Total expenses | $2,500 |

| Expense source | Amount |

| Rent | $800 |

| Groceries (average) | $300 |

| Utilities | $80 |

| Car expenses (insurance, maintenance, gas) | $200 |

| Health insurance and expenses | $120 |

| Credit card balance | $500 |

| Cellular and internet | $100 |

| Recreation | $400 |

This is a budget surplus.

Human Capital & Labor Market

Please read the interactive book below. For additional information on this topic, review Personal Finance, Chapter 18.1

Benefits of Going to College

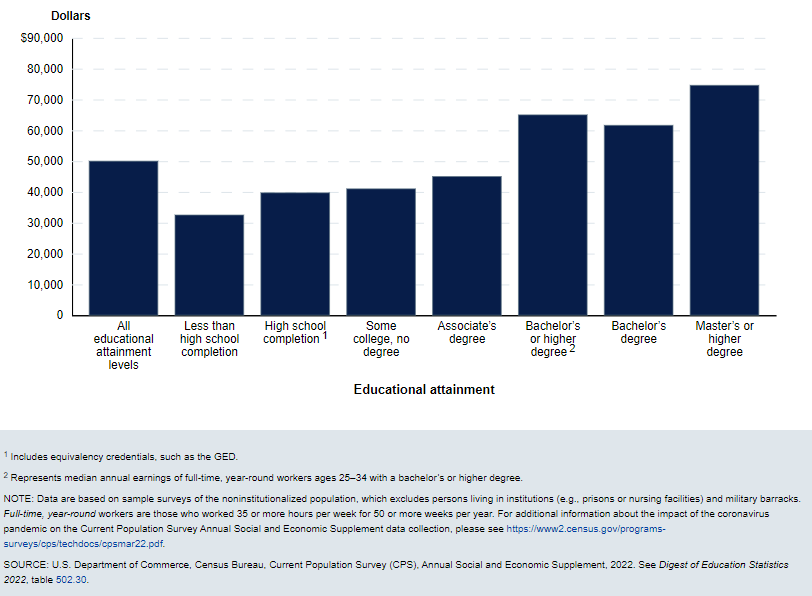

Expand your potential earnings (see Figure 1)[1]

- Bachelor’s degree holders generally earn 75% more than those with just a high school diploma, according to “The College Payoff,” a report from the Georgetown University Center on Education and the Workforce—and the higher the level of educational attainment, the larger the payoff.

- Finishing college puts workers on track to earn a median of $2.8 million over their lifetimes, compared with $1.6 million if they only had a high school diploma, the report found.

Additional Benefits of Going to College

- create long-lasting relationships and professional connections

- achieve job security

- explore different career options

- experience independence

- learn valuable skills

- access better job benefits

For more information on this topic, view Hannah Bareham’s article, 7 Reasons to Go to College

Costs of Going to College[2]

- The average cost of college in the United States is $35,551 per student per year, including books, supplies, and daily living expenses.

- The average cost of college has more than doubled in the 21st century, with an annual growth rate of 7.1%.

- The average in-state student attending a public 4-year institution spends $25,707 for one academic year.

- The average private, nonprofit university student spends a total of $54,501 per academic year.

For more information on this topic, view Melanie Hanson’s article, Average Cost of College & Tuition

Think About It…

Differences in Living Expenses

- Whether you go to college or not, you must consume food to survive, have a place to live, buy clothes, and so on.

- Therefore, living expenses themselves should not be part of the cost of attending college.

- Only the difference between (living expenses at college − living expenses not living at college) should be included.

Let’s look at an example.

Example: Let’s Compare the Rent Differences

Jane is considering whether or not to attend college. In addition to other expenses, she wants to determine how much rent would cost each month.

Her options are:

If Jane attends college, she would be required to live on campus. Jane would need to pay the college $800 per month for a full-furnished single room.

If Jane does not attend college, she could live with her parents. In this case, her parents ask her to pay $100 per month as rent to live in her own room.

To determine Jane’s rent difference, she would need to subtract $100 from $800. Jane would be paying at least $100 each month for rent, regardless of whether she attended college or not.

Jane would pay an extra $700 per month attending college.

$700 should be part of Jane’s cost of attending college, not $800.

Opportunity Cost

What Is An Opportunity Cost?

Opportunity cost is an important component that is always forgotten. Opportunity cost of a decision is the value of the best alternative you give up, given limited resources.

Determining Opportunity Cost

Remember choosing your top choice for your future with these three steps from the first practice activity?

Step 1 List all of your choices.

Step 2 Rank your choices.

Step 3 Select number one from your ranking.

The opportunity cost of selecting your top choice is the value of your second choice only.

Example of Determining Opportunity Cost

Let’s use your choices to determining the opportunity cost together.

Top Ways to Pay For College—And Other Options

There are many options available to pay for college.

Career Planning

A career is a lifework a person chooses to use personal talent, education, and training. Career planning is finding employment that will use your interests and abilities and support you financially.

- Some people know what they want to do at an early age. For most people, however, the path is not that clear.

- Career planning and development can be a process of trial and error as you learn your abilities and preferences by trying them out.

Your lifecycle of career development may follow the pattern shown in the table below:

Table 6: Lifecycle of Career Development

| Life Stage | Career Concerns |

| Exploration and establishment | Develop your skills, acquire knowledge, explore jobs, start earning income, gain experience |

| Growth | Advance your career, leverage knowledge and skills, increase earnings |

| Accomplishment | Achieve your goals, maximize earnings, build on success and reputation |

| Late Career | Redirect knowledge and skills, contribute, mentor successors |

Finding A Job

When searching for a job market, An excellent place to start is the U.S. Department of Labor’s “Occupational Outlook Handbook.”

The handbook is updated annually. This resource reports the training and education needed for hundreds of industries and specific jobs, what you will earn, what your job prospects are, what the work entails, and what the working conditions are like.

When searching for job openings, think of it like this: you are looking for a buyer of your labor, so you need to find out where jobs in your field are advertised. Examples of places to look include trade magazines, professional organizations, career fairs, employment agencies or websites, government or company websites, and college career development offices.

Also, remember networking is another valuable way to expand your job search.

Sources of Information About Jobs

Selling Yourself: Your Cover Letter and Résumé

- The cover letter should get a prospective employer to read your résumé.

- The résumé should get the employer to offer you an interview.

Selling Yourself: Your Interview

The interview should get the employer to offer you the job.

Accepting an Offer

- A job offer includes information on the

- job

- compensation, including benefits

- opportunities for advancement

- Accepting a job offer may involve

- evaluating the offer in relation to your needs

- examining a job contract

- negotiating the compensation

Additional resources

Review these resources if you want to learn more about this topic.

Key Takeaways

- Use a cash flow statement to gauge where you have been (past), a balance sheet to gauge where you are now (present), and a budget to get where you want to go financially (future).

- Every decision has an opportunity cost. Do not forget your opportunity cost of going to college.

- Choose a career that will be enjoyable and suit your skills. STEM majors are not the only academic majors that teach employable skills and pay well upon graduation.

- Career success requires planning both before and during your working life.

Attributions

This chapter contains content from the following source:

Personal Finance was adapted by Saylor Academy under a CC BY-NC-SA 3.0 without attribution as requested by the work’s original creator or licensor.

Further Reading & References

The following citations are for resources linked in the text and learning activities, and/or recommended by the author for further reading. Footnotes below are for additional references paraphrased or quoted in the chapter content.

Bareham, H. (2022, October 27). 7 reasons to go to college. Bankrate. https://www.bankrate.com/loans/student-loans/reasons-to-go-to-college/

College Ave. (2023 May 5). How to pay for college: top 6 ways to pay for college. https://www.collegeave.com/articles/how-to-pay-for-college/

College Ave Student Loans. (2019, July 19). How to pay for college: 6 best ways to help pay for college [Video]. YouTube. https://www.youtube.com/watch?v=OWNLd8tShq8

Dickler, J. (2023, March 1). College is still worth it, research finds—Although students are growing skeptical. CNBC. https://www.cnbc.com/2023/03/01/is-college-worth-it-what-the-research-shows.html

GCF Global. (n.d.). Career planning and salary. https://edu.gcfglobal.org/en/careerplanningandsalary/

GCF Global. (n.d.). Make a career plan. https://edu.gcfglobal.org/en/careerplanningandsalary/make-a-career-plan/1/

Gillan, K. (2023). 8 ways to pay for college. Citizens Financial Group, Inc. https://www.citizensbank.com/learning/ways-to-pay-for-college.aspx

Haughn, A. (2023, February 7). Student loan debt statistics. Bankrate. https://www.bankrate.com/loans/student-loans/student-loan-debt-statistics/

Indeed Editorial Team. (2023, March 10). The 6-step career-planning process. Indeed. https://www.indeed.com/career-advice/career-development/career-planning-process

Kagan, J. (2023, February 27). What is income tax and how are different types calculated? Investopedia. https://www.investopedia.com/terms/i/incometax.asp

Ramsey Solutions. (2023, May 31). How to make a budget: Your step-by-step guide. https://www.ramseysolutions.com/budgeting/how-to-make-a-budget

U.S. Bureau of Labor Statistics. (n.d.). Occupational outlook handbook. United States Department of Labor. https://www.bls.gov/ooh/

- National Center for Education Statistics. (2023). Annual Earnings by Educational Attainment. Condition of Education. U.S. Department of Education, Institute of Education Sciences. Retrieved November 27, 2023, from https://nces.ed.gov/programs/coe/indicator/cba. ↵

- Hanson, M. (2023, November 18). Average cost of college & tuition. Education Data Initiative. https://educationdata.org/average-cost-of-college ↵