5. Making Your Purchasing Decisions

Learning Objectives

- Explain the relationship between price and quantity.

- Distinguish between purchasing and leasing a vehicle.

- Distinguish between purchasing and renting a home.

Consumer Purchases

Consumer purchases refer to the items we use in daily living, such as clothing, food, electronics, and appliances. These purchases reflect our tastes, lifestyle choices, and values. When making consumer purchases, it is essential to stay within your budget. This means spending less than you earn so that you can afford necessary expenses and still have money left over for discretionary purchases. Purchasing decisions are always limited by the income available. This means you may have to decide what you buy based on your financial resources. For example, you may want to purchase products A and B, but if you can only afford one, you must choose between them.

Buyers and Sellers

In a market, we have two parties: buyers and sellers.

-

Buyers decide demand and sellers decide supply.

-

Consumer purchase refers to demand.

Think About It: What Factors Affect Your Decisions?

Assuming you want to buy a large pizza for dinner, what factors will affect your final decision?

-

Which brand (e.g., Pizza Hut/Papa John’s/Marco’s)?

-

The number of toppings and what they are.

-

Price or promotions (e.g., Can I earn rewards? Do I have coupons?)

Factors Influencing Demand

Several factors influence the demand for a good or service.[1]

-

Price of the good

-

Price of related goods

-

Disposable income (or net pay)

-

Tastes or preferences

-

Consumers’ expectations about future

Let’s examine these factors in more detail.

Planned Buying

Planned buying is a deliberate process of purchasing a product or service previously identified as a need or want. Planned purchases are more common in big-ticket items or irregular purchases. Examples of planned purchases include homes, cars, appliances, and large furniture. You tend to make these purchases more carefully because you must live with your decision for years instead of days.

The Planned Buying Decision Process

The decision process of planned buying can be broken down into three stages:

-

Pre-purchase (before you buy)

-

Purchase

-

Post-purchase (after you buy)

Let’s examine these stages in more detail.

Affording A Vehicle

A vehicle purchase is a planned buying event and many adults will buy a vehicle several times during their lifetime. As with any large purchase, there are three stages in a vehicle purchase: pre-purchase, purchase, and post-purchase.

Factors to consider about your next vehicle during the purchasing process:

-

Personal preferences

-

Price

-

Condition

-

Insurance

-

Resale value

-

Repair and maintenance expenses

-

Financing costs

Purchasing vs. Leasing

Getting a new vehicle is an exciting milestone. But before choosing an SUV or truck in your favorite color, you must decide whether to lease or buy your next ride.

Leasing and buying are both valid ways to get your hands on a new vehicle. Leasing could get you more affordable monthly payments. But more than the cost savings may be needed to justify the downsides of leasing, making purchasing a vehicle the better choice.

Buying offers fewer restrictions than leasing on how much you can drive and what you can do with the vehicle. Plus, you own the vehicle at the end of the loan. But leasing is a less expensive option month-to-month if you want to get into a luxury vehicle.

Let’s look at two options and you can decide which works best for you.

Advantages vs. Disadvantages

Lease a Vehicle

Purchase a Vehicle

Ways to Fund Your Choice

Making the Decision: Purchase or Lease?

Thomas wants to compare purchasing costs versus leasing his first vehicle, a 2023 Toyota Corolla. Can you help him determine the best option?

Renting vs. Buying a Home

Buying a home is a significant financial decision that can have a lasting impact on your life. On the one hand, a home can be a valuable asset that can appreciate in value over time. On the other hand, buying a home can be expensive, and there are many other factors to consider, such as your budget, lifestyle, and long-term goals.

When you move out of your parents’ home, you may start by renting a place to live. Renting can be a good option if you are still determining where you want to settle down or are not ready to make a long-term commitment. However, renting can also be expensive, and you do not build any equity in a rental property.

If you are considering buying a home, you should keep a few things in mind. First, you must ensure you can afford the monthly mortgage payments. You will also need to property factor in taxes, homeowners’ insurance, and maintenance costs. Finally, you will need to decide how long you plan to stay in the home. If you are unsure, it may be better to rent now.

Ultimately, whether to rent or buy a home is a personal decision. There is no right or wrong answer, and the best option for you will depend on your circumstances.

Table 15: Advantages and disadvantages of renting or owning a home

| Housing Option | Advantages | Disadvantages |

|---|---|---|

| Renting |

|

|

| Own |

|

|

Renting a Home

When you rent a home, there are several costs that you will need to consider. It is essential to factor in all of these costs when considering renting a home. This will help you to make sure that you can afford the monthly payments and that you are prepared for any unexpected expenses.

The most obvious cost is rent—the monthly fee you pay the landlord to use the property.

Another significant cost is the security deposit. You will need to pay the landlord this sum when you move in. The landlord holds the security deposit to guarantee you will not damage the property during your tenancy.

In addition to rent and the security deposit, there are several other costs that you may need to consider, such as:

Application Fee

This is a fee that you will need to pay to the landlord when you apply for the property.

Moving Costs

The cost of moving your belongings to the new property.

Parking Fee

If you need a parking space, you may need to pay a monthly fee to the landlord or a parking company.

Pet Fee

If you have a pet, you may need to pay a monthly fee to the landlord.

Renter’s Insurance

This is insurance that protects your belongings in case of damage or theft.

For additional information on this topic, visit 21 Costs of Renting (Upfront, Recurring, and Hidden)

Purchasing a Home

Buying a home is a major financial decision and the initial costs can be significant. All factors should be carefully considered before moving forward.

Purchasing a Home—How Much Can You Afford and What Are Your Preferences?

How much can you afford to spend on a home?

When considering buying a home, it is essential to determine how much you can afford to spend. There are several factors to consider, including your income, debt, and savings.

Here are some tips for determining how much you can afford:

-

Use an online mortgage affordability calculator. This helps you get a rough idea of how much house you can afford.

-

Stay within the maximum you can afford. You need to allow for closing costs and some liquidity for unexpected bills.

-

Allow for continued saving. You will still need to save for retirement, emergencies, and other expenses even after you buy a home.

-

Consider current economic conditions and your job security. If you are worried about job security, you may want to err on the side of caution and buy a less expensive home.

-

Decide on a price range before identifying a home you want. This will help you to narrow down your search and avoid overspending.

Consider the Factors That Affect Your Home Choice

Many factors can affect your choice of home. Some of the most important factors include:

-

Personal preference: This includes your likes and dislikes, as well as your lifestyle and needs. For example, you may need a larger home with more bedrooms if you have a family.

-

Price of the home: This is an essential factor, as you need to be able to afford the home you choose. You must consider your income, debt, and savings when determining how much you can afford to spend.

-

Location and size of the home: The location of the home and its size are also important factors. You need to consider your commute to work, the schools in the area, and the amenities that are available. You also need to decide how much space you need.

-

Re-sale value of the home: If you plan to sell the home in the future, you need to consider its resale value. You want to ensure that you are buying a home that will hold its value or appreciate in value over time.

-

Use of the home: Are you buying the home as a primary residence or an investment? If you are buying a home as a primary residence, you must consider your needs now and in the future. If you are buying a home as an investment, you need to consider the potential for profit.

-

Your age and stage of life: Your age and stage of life can also affect your home choice. For example, if you are young and single, you may not need as much space as you would if you had a family.

-

Your family size: If you have a family, consider how many bedrooms and bathrooms you need. You also need to consider the age of your children and their needs.

-

Your health: If you have a health condition, you need to consider the accessibility of the home. You may need a home with a wheelchair ramp or a bathroom with grab bars.

-

Your financial situation: Your financial situation is also an essential factor. You need to ensure you can afford the monthly mortgage payments, property taxes, and insurance. You also need to have enough money saved for a down payment and closing costs.

It is important to consider all these factors when choosing a home. This will help you find a home that meets your needs and budget.

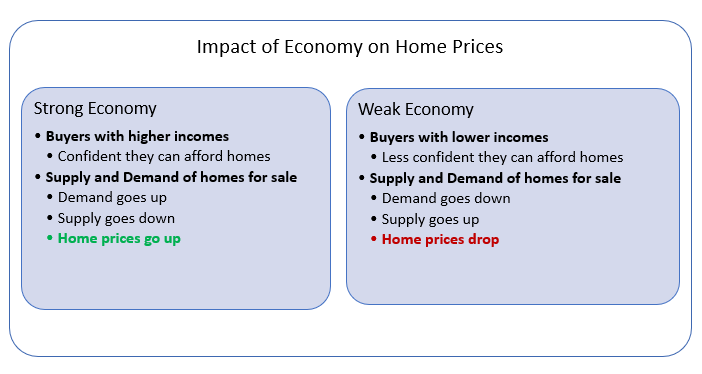

Purchasing a Home—Home Valuation

The value of a home is not always constant. It can fluctuate based on several factors, including economic conditions. For example, home values may decline during a recession as demand for homes decreases. Conversely, home values may increase during a strong economy as demand for homes increases.

Here are some of the factors that can affect the valuation of a home:

- Location: The location of a home is one of the most critical factors that affect its value. Homes in desirable locations, such as close to schools, parks, or shopping, tend to be worth more than homes in less desirable locations.

- Size: The size of a home also affects its value. Larger homes tend to be worth more than smaller homes.

- Condition: The condition of a home also affects its value. Homes that are in good condition tend to be worth more than homes that are in poor condition.

- Demand: The demand for homes in a particular area also affects their value. If there is a high demand for homes in an area, the prices of homes will tend to be higher.

- Economic conditions: Economic conditions can also affect the valuation of homes. During a recession, home values may decline as demand for homes decreases. Conversely, home values may increase during a strong economy as demand for homes increases.

It is important to consider all these factors when determining the value of a home. This will help you make an informed decision about buying or selling a home.

Purchasing a Home—The Home-Buying Process

The home-buying process can be daunting, but it can be broken down into a few key steps:

Step 1

Increase your credit score: Your credit score will affect the interest rate you’ll get on your mortgage, so it is important to start by increasing your credit score. You can do this by paying your bills on time, keeping your credit utilization low, and avoiding opening new accounts.

Step 2

Get pre-approved for a mortgage: Once your credit score is in good shape, you can get pre-approved for a mortgage. This will give you an idea of how much you can afford to borrow and will show sellers that you are a serious buyer.

Step 3

Start your search: Once you are preapproved for a mortgage, you can start your search for a home. You can search online or in person and you will want to consider factors like location, size, and price.

Step 4

Make an offer: Once you find a home you like, you will need to make an offer. Your offer should include the price you are willing to pay and any contingencies, such as a home inspection.

Step 5

Negotiate the terms: The seller may counter your offer and you must negotiate the terms. This is where your real estate agent can be helpful.

Step 6

Close on the home: Once you have agreed to the terms, you will need to close on the home. This is when you will sign all the paperwork and officially become a homeowner.

The home-buying process can be a long and complicated one, but it is important to remember that it is a journey. Following these steps can help to make the process a little bit easier.

Purchasing a Home—Financing Your Home

When you are considering a mortgage loan, there are a few key decisions you will need to make that will affect your financial plan. These include:

Question 1

How much mortgage can you afford? This will depend on your income, your debt, and your savings. You will need to make sure that you can afford the monthly payments, closing costs, and other up-front expenses.

Question 2

What maturity (i.e., loan term) should you select? The maturity is the length of time it will take you to repay the loan. Shorter-term loans have lower interest rates, but they also have higher monthly payments. Longer-term loans have higher interest rates, but they have lower monthly payments.

Question 3

How many years do you think it will take to pay off your mortgage? This will depend on your financial situation and your goals. If you want to pay off your mortgage quickly, you may want to choose a shorter-term loan. If you are more comfortable with a lower monthly payment, you may want to choose a longer-term loan.

Question 4

Should you consider a fixed-rate or an adjustable-rate mortgage? A fixed-rate mortgage has an interest rate that stays the same for the life of the loan. An adjustable-rate mortgage has an interest rate that can change over time. Fixed-rate mortgages are generally more stable, but adjustable-rate mortgages can offer lower initial interest rates.

Do your own research before asking for a second opinion. Doing your own research before choosing a mortgage loan is important. This will help you understand the options available to you and make the best decision for your financial situation.

It is essential to consider all these factors when making mortgage loan decisions. This will help you to create a sound financial plan and to avoid making decisions that you will regret later.

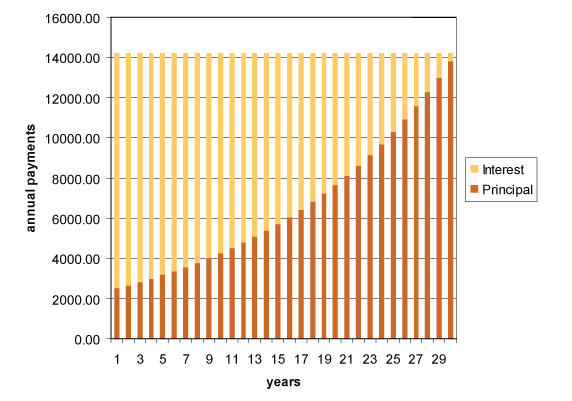

Purchasing a Home—Fixed-Rate Mortgages

A fixed-rate mortgage is a loan with an interest rate that remains the same for the life of the loan. This means that your payments will be the same each month, which can provide predictability and stability. Fixed-rate mortgages are the most popular type of financing for homebuyers because they offer this predictability.

In the United States, fixed-rate mortgages typically have terms of 10, 15, 20, or 30 years. The longer the term, the lower your monthly payments will be, but the more interest you will pay over the life of the loan.

With a fixed-rate mortgage, your payment amount stays the same, but the breakdown of your payment varies based on the amortization schedule. The amortization schedule is a table that shows how much of your payment goes toward principal and interest each month. In the early years of your loan, most of your payment will go toward interest, but as you pay down the principal, more of your payment will go toward the principal.

A fixed-rate mortgage may be a good option if you are looking for a predictable and stable mortgage. However, it is important to compare different loan terms and interest rates to find the best deal for your financial situation.

Think About It: Financing With a Fixed-Rate Mortgage

What do you see when you look at this table?

With a fixed-rate mortgage, you pay most of the interest in the first half term of your loan. Ramsey Solutions suggests you “choose a 15-year fixed-rate conventional loan if you are going to get a mortgage. You will save thousands overall compared to expensive FHA, VA, and 30-year fixed-rate loans.”[2]

Deciding Whether to Rent or Buy

The decision of whether to buy or rent a home is a personal one. Both options have pros and cons, and the best choice for you will depend on your circumstances. Once you have decided whether you want to own or rent, you need to estimate the total cost of each option. This will help you make an informed decision about which option is right for you. Once you have estimated the total cost of each option, you can compare the two and decide which one is right for you.

Table 16a: Total cost of renting over a three-year period

| Cost of renting | Amount per year | Total over next 3 years |

| Rent ($1,700 per month) | $20,400 | $61,200 |

| Renter’s insurance | 0 | 0 |

| Opportunity cost of security deposit | $85 | $255 |

| Total cost | $20,485 | $61,455 |

Table 16b: Total cost of buying a home over a three-year period

| Cost of purchasing (see caption) | Amount per year | Total over next 3 years |

| Mortgage ($1,709 per month) | $20,508 | $61,524 |

| Down payment (first year only) | $15,000 | |

| Opportunity cost of down payment | $75 | $225 |

| Property taxes ($167 per month) | $2,004 | $6,012 |

| Property Mortgage Insurance (PMI) ($292 per month) | $3,504 | $10,512 |

| Home insurance ($142 per month) | $1,704 | $5,112 |

| Closing costs (first year only) | $8,550 | |

| Maintenance cost (lawn care, saving for AC & roof replacement) | $2,041 | $6,123 |

| Total tax savings | -$4,428 (average) | -$13,284 |

| Equity investment (down payment + 3 years principal) | -$26,160 | |

| Total cost ($2,310/monthly payment) | $23,292 | $73,614 |

In this example, renting is less expensive than buying.

Key Takeaways

-

The better-informed consumer is more likely to negotiate a more satisfying purchase, so it is essential to be thorough in the pre-purchase research.

-

Consider purchasing a late-model used vehicle rather than a new one.

-

Consider the price of buying a vehicle and the costs of operating it (vehicle property tax, fuel, maintenance, repair, insurance, registration).

-

Do not forget the opportunity cost of using your own money.

-

The longer you intend to keep the vehicle, the less sense it makes to lease.

-

Only spend up to 25% of your monthly net pay on housing costs.[3]

Attributions

This chapter contains content from the following sources in the text and learning activities:

(1) “Personal Finance: Chapter 8.1″ was adapted by Saylor Academy under a CC BY-NC-SA 3.0 without attribution as requested by the work’s original creator or licensor.

(2) “National Highway Traffic Safety Administration” by U.S. Department of Transportation is in the Public Domain

(3) “Personal Finance: Chapter 8.2” was adapted by Saylor Academy under a CC BY-NC-SA 3.0 without attribution as requested by the work’s original creator or licensor.

(4) “Personal Finance: Chapter 9.2” was adapted by Saylor Academy under a CC BY-NC-SA 3.0 without attribution as requested by the work’s original creator or licensor.

(5) “What Factors Change Demand” [Article] by Khan Academy (CC-BY-NC-SA 4.0) is a modified derivative of 3.2 Shifts in Demand and Supply for Goods and Services in Principles of Microeconomics 3e by OpenStax (CC BY 4.0).

Further Readings & References

The following citations are for further readings, either linked in the text and learning activities or recommended by the author. Footnotes below are for additional references paraphrased or quoted in the chapter content.

Bankrate. (2023). Minimum payment calculator. https://www.bankrate.com/finance/credit-cards/minimum-payment-calculator/

Betterton, R. (2023, December 5). Pros and cons of leasing vs. buying a car. Bankrate. https://www.bankrate.com/loans/auto-loans/leasing-vs-buying-a-car/

Buchenau, Z. (2021, March 4). 21 costs of renting (Upfront, recurring, and hidden). https://bethebudget.com/costs-of-renting/

Chen, J. (2022, May 31). Security deposit: Definition, primary purpose, and example. Investopedia. https://www.investopedia.com/terms/s/security-deposit.asp

Edmunds. (2023). Let’s find your perfect car. https://www.edmunds.com

Etags.com. (2023). The pros and cons of leasing a car—here are your facts. Retrieved December 19, 2023 from https://www.etags.com/blog/pros-and-cons-of-leasing-a-car/?gad=1&gclid=Cj0KCQjw8NilBhDOARIsAHzpbLCznou5XiHh990G8z6Q0T0106qLL6vODeNQxg2dADBLF9Qm7Bqv5boaAsrZEALw_wcB

Goff, K. (2023, September 22). Mortgage points: What are they and how do they work? Bankrate. https://www.bankrate.com/mortgages/mortgage-points/

Goff, K. (2023, December 5). What is a fixed-rate mortgage and how does it work? Bankrate. https://www.bankrate.com/mortgages/what-is-a-fixed-rate-mortgage/

InfoBlog. (2017, May 11). Make the right decision using a decision matrix. Infonautics GMBH. Retrieved December 19, 2023 https://www.infonautics.ch/blog/decision-matrix/

Kamel, G. (2023, November 20). Car depreciation: How much is your car worth?. Ramsey Solutions. https://www.ramseysolutions.com/saving/car-depreciation

Kelley Blue Book Co. (2023). Kelley knows cars. https://www.kbb.com

LaPonsie, M. (2023, September 15). How much to budget for home maintenance. U.S. News & World Report. https://realestate.usnews.com/real-estate/articles/guide-to-average-home-maintenance-costs

McMillin, D. (2023, August 27). How much house can I afford?. Bankrate. https://www.bankrate.com/real-estate/new-house-calculator/

Wells Fargo. (2023). The components of a mortgage payment. https://www.wellsfargo.com/mortgage/learning/mortgage-payment-components-video/

- Khan Academy. (n.d.). What factors change demand [Article]. Retrieved December 12, 2023, from https://www.khanacademy.org/economics-finance-domain/microeconomics/ supply-demand-equilibrium/demand-curve-tutorial/a/what-factors-change-demand ↵

- Ramsey Solutions. (2023, October 25). The basics of personal finance. https://www.ramseysolutions.com/budgeting/the-basics-of-personal-finance ↵

- Ziraldo, K. (2023, July 12). How much of your income should go to your mortgage? Rocket Mortgage. https://www.rocketmortgage.com/learn/percentage-of-income-for-mortgage#:~:text=The%2025%25%20rule%20allows%20borrowers,income%20after%20taxes%20by%200.25l ↵