7. Protecting Against Risk

Learning Objectives

- Recognize how and why insurance is used.

- Identify various types of insurance you may need, like life insurance, health insurance, and other options.

- Recognize what a government safety net is and how it works.

What Is Risk?

What is a risk? Risk is the uncertainty about the outcome of an event. Life is full of risks. For example, your financial stability can be destroyed by a fire, a car accident, a surprise medical bill, or untimely death. You cannot eliminate risks; however, you can decide how to handle them. You can choose to accept risks and be responsible for all the costs if something unexpected happens. Or you can insure against risk, which means paying someone to share your risk, thus reducing your risks to a manageable level.

When deciding whether to buy insurance, you need to consider the likelihood of loss and the severity of the loss. Remember, the adverse event may never actually happen. One simple rule is to insure the losses that you cannot afford and pay the small losses out of your own pocket. Upon completion of this learning unit, you will know how insurance works and get familiar with the leading types of insurance you may need now or in the future, such as property insurance, health insurance, and life insurance.

Why Do People Buy Insurance?

Risk is a part of life. We cannot eliminate risk; however, we can choose whether and how to protect against it.

Accept Risk

Accepting risk is feasible when the likelihood of financial loss is low. However, we must remember that we do not control adverse events.

Insure Against Risk

You weigh the cost of the consequence of a risk that may never actually happen against the cost of insuring against it. Buying insurance differs from other purchases in that there is no immediate benefit.

What Is Insurance?

Insurance is a way to manage your financial risks (i.e., you pay someone else to share your risks). When you buy insurance, you purchase protection against unexpected financial losses. If something severe or unexpected occurs, the insurance company pays you or someone you choose. If you do not have insurance and an unforeseen or unintentional event happens, you may be responsible for all related costs.

There are various types of insurance available.

Table 17: Types of Insurance for the Individual

| Type of Insurance Protection | Financial Loss it Protects Against |

| Life insurance | Loss of income — Provides for your family after your death |

| Health Insurance | Medical bills — Covers the cost of hospitalization, visits to the doctor’s office, prescription medicines |

| Disability Insurance | Loss of income — Pays a certain percentage of an employee’s wages (or fixed sum) weekly or monthly if you become unable to work through illness or an accident |

| Homeowner’s Insurance | Home repairs, medical bills/liability — Covers cost of repairs or loss due to fire, theft or other named perils. Pays for medical bills if someone is injured while in your home. |

| Automobile Insurance | Car repairs, medical bills/liability — Covers the cost of repairs due to an accident; pays for medical bills if someone is injured in the accident |

What Do You Insure?

Deciding what and how to insure is a process of determining the costs of loss and how willing you are to pay to eliminate those costs. Insurance costs can also be lowered through risk avoidance or reduction strategies.

For example, installing an alarm system in your home may reduce homeowners’ insurance premiums because that minimizes the theft risk. Of course, installing an alarm system has a cost too.

Terms Related to Insurance and Common Questions

Liability: The risk that your use of your property will injure someone or something else. For example, you are liable for your dog’s attack on a pedestrian.

Insurance agent: The person who recommends insurance policies for clients.

Premium: The cost of obtaining insurance.

Insurance policy: The contract between an insurance company (i.e., insurer) and a policyholder (i.e., insured).

Deductible: A set dollar amount that you are responsible for paying before any coverage is provided by your insurer.

To learn more, review the following resources.

- Insurance: Definition, How It Works, and Main Types of Policies Be sure to check out the short video, Insurance, about halfway down the page!

- How Do Insurance Companies Make Money? Business Model Explained

Types of Insurance

We will now take some time to review the following types of insurance:

-

Property insurance

-

Auto insurance

-

Homeowner’s/renter’s insurance

-

-

Health insurance

-

Disability income insurance

-

Life insurance

-

Private mortgage insurance

Property Insurance

Property insurance covers the loss of your property from either damage or theft. It also protects you from liability for any use of the property that causes damage to others or others’ property.

For example, you are liable for your fallen tree’s damage to a neighbor’s fence. For most people, insurable property risks are covered by insuring two types or categories of property: automobile and home.

FYI: Umbrella Personal Liability Policy

This supplement to auto and homeowner’s insurance provides additional personal liability coverage.

Health Insurance

Health insurance is a contract between an insurance company and a policyholder. The contract is usually a one-year agreement related to illness, injury, pregnancy, or preventative care.

The insurer agrees to pay all or some of the insured person’s healthcare costs in return for a monthly premium payment. Health insurance pays most medical and surgical expenses and preventative care costs. The higher the monthly premium, the lower the out-of-pocket costs to the policyholder.

Out-of-Pocket Costs (for policyholders)

Co-pays require the policyholder to pay a set share (amount) of the cost for specific services or procedures (e.g., for physician’s visits or prescriptions).

Deductibles are an amount payable by the policyholder before the insurer assumes any expenses.

Generally, all insurance plans have co-pays and deductibles, but these out-of-pocket expenses are capped by federal law. The more costs you shoulder, the less risk to the insurer, and so the less you pay for the insurance policy.

Co-insurance requires you and your insurance carrier to each pay a share of eligible costs that add up to 100%.

One of the most common coinsurance breakdowns is the 80/20 split. Under the terms of an 80/20 coinsurance plan, the insured is billed for 20% of covered medical costs while the insurer pays the remaining 80%.

To learn more, visit Coinsurance: Definition, How It Works, and Example. Be sure to check out the short video, Co-Insurance, about halfway down the page!

Types of Health Insurance Plans

Your health insurance decision is not whether to obtain it but which health plan to purchase and how much coverage to purchase.

Types of health insurance plans:

-

Preferred provider organization (PPO) plan

-

Health maintenance organization (HMO) plan

-

Point of service (POS) plan

-

Exclusive provider organization (EPO)

-

Health savings account (HSA)-qualified plan

-

Indemnity plans

To learn more, visit Common Types of Health Insurance Plans

FYI: Affordable Care Act

In 2010, President Barack Obama signed the Patient Protection and Affordable Care Act (PPACA) into law. ACA allows young adults to continue on their parent’s plan until age 26. Health insurers cannot deny applicants based on preexisting conditions. The ACA established the federal health insurance marketplace for quality insurance plans at affordable rates. To learn more, review Health Insurance: Definition, How It Works

Disability Income Insurance

Disability income insurance provides income protection in the event that a policyholder is prevented from working and earning an income due to a disability (e.g., injury or illness).

Some plans pay partial benefits if the policyholder returns to work part-time, and some do not. It is essential to understand the limits of your plan’s coverage. All plans have a waiting period from the time of disability to the collection of benefits. Most are between 30 and 90 days, but some are as long as 180 days. The longer the waiting period is, generally, the less the premium.

To learn more, review Personal Finance, Chapter 10, Section 10.3: Insuring Your Income

Life Insurance

Life insurance is designed to protect your dependents against the loss of your income in the event of your death.

A life insurance policy is a legal contract between a life insurance company and the policyholder. It guarantees the life insurance company pays a sum of money to one or more named beneficiaries when the policyholder dies in exchange for premiums paid by the policyholder regularly.

To learn more, visit Life Insurance: What It Is, How It Works, and How To Buy a Policy . Be sure to check out the short video, What is Life Insurance, about halfway down the page!

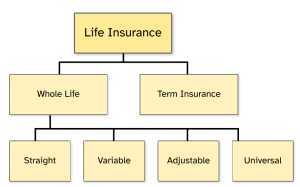

Life Insurance: Term and Whole Life

Life insurance may be divided into two basic classes: permanent and temporary.

Think Before You Buy

Before purchasing life insurance, you should:

-

Determine what you want to do with it. For example:

-

Pay off the mortgage?

-

Put your kids through college?

-

Cover the costs of your medical expenses or funeral expenses?

-

-

Based on your goals, determine how much you may need and how long you will need coverage.

-

Review your financial situation and determine how much premium you can afford.

To learn more, visit Life Insurance: What It Is, How It Works, and How To Buy a Policy

Private Mortgage Insurance

Private mortgage insurance, also called PMI, is a type of mortgage insurance. PMI is usually required when you have a conventional loan and make a down payment of less than 20% of the home’s purchase price.

FYI: conventional loans are made by private lenders such as banks, credit unions, and mortgage companies. A lender might also require PMI if a borrower is refinancing with a conventional loan and equity is less than 20% of the home value.

Mortgage insurance is not for your benefit. It is for your lender’s.

PMI protects your lender (i.e., bank, credit union, or mortgage company) from loss if you wind up unable to make your payments. If you default on the loan, it will not protect you from losing your house through foreclosure.

How Can I Avoid Paying PMI?

-

Pay at least a 20% down payment.

-

Pay a higher interest rate with a small down payment.

To learn more, review the following resources:

Government Safety Net

Social Security

Social Security is a federal program in the U.S. that provides retirement benefits and disability income to qualified people and their spouses, children, and survivors.

Retirement benefits are calculated based on your average indexed monthly earnings (AIME) during your 35 highest-earning years, so it varies from person to person.

Workers must be at least 62 years old and have paid into the system for 10 years or more to qualify for Social Security retirement benefits. Workers who wait to collect Social Security until age 70 will receive higher monthly benefits.

How Social Security Works

You pay into the program through taxes (i.e., payroll withholding or Social Security taxes) during your working years and get payments upon retirement.

The taxes you pay go into two Social Security trust funds:

-

the Old-Age and Survivors Insurance Trust Fund (OASI) for retirees

-

the Disability Insurance Trust Fund (DI) for disability beneficiaries

These two funds are used to pay benefits to people who are currently eligible for them. The money that is not spent remains in the trust funds.

Who Can Get Retirement Benefits?

People who have paid into the Social Security system for at least 10 years are eligible.

-

They are eligible for early retirement benefits at age 62.

-

They can get a higher monthly benefit if they wait until their full retirement age (FRA), between 66 and 67.

Social Security does not provide adequate income to support most people solely. It is essential to supplement it with other sources of retirement funding, such as individual retirement accounts (IRAs) and employer-sponsored plans (e.g., 401(k) or 403(b)).

To learn more, visit What Is Social Security?

Who Qualifies for Social Security Disability Benefits?

According to the Social Security website, you must have worked a certain length of time in jobs and have a medical condition that meets Social Security’s definition of disability.

You can (and should) apply for disability benefits as soon as you believe you are disabled. There is a mandatory waiting period before you can receive payments. Disability benefits are based on each individual’s average lifetime earnings.

To learn more, visit What Are the Maximum Social Security Disability Benefits?

Medicare, Medicaid, and Children’s Health Insurance Program (CHIP)

Medicare, Medicaid, and the Children’s Health Insurance Program (CHIP) are federal health insurance plans that extend coverage to older, disabled, and low-income people.

Medicare

Medicare is the federal health insurance program for:

-

People who are 65 or older

-

Certain younger people with disabilities

-

People with end-stage renal disease

For more information and an overview of services offered by Medicare, visit Welcome to Medicare.

Medicaid

Medicaid provides health coverage to millions of Americans, including eligible low-income adults, children, pregnant women, elderly adults, and people with disabilities. The program is funded jointly by states and the federal government.

The federal government has general rules that all state Medicaid programs must follow, but each state runs its own program. This means eligibility requirements and benefits can vary from state to state.

Children’s Health Insurance Program (CHIP)

CHIP provides low-cost health coverage to children (under the age of 19) in families that earn too much money to qualify for Medicaid. The program is funded jointly by states and the federal government. States have the flexibility to design their own program within federal guidelines, so benefits vary by state and the type of CHIP program.(6)

To learn more, visit Children’s Health Insurance Program (CHIP).

Key Takeaways

-

Use the same insurance company for your insurance needs; it can reduce your insurance premium.

-

To fit your insurance choice within your financial plan, ask yourself:

-

Do I have adequate insurance to protect my wealth?

-

How much insurance should I plan to have in the future?

-

-

PPOs vs. HMOs: Trade-offs between flexibility in selecting physician and premium.

PPOs have more flexibility and a higher premium.

-

There is no limited enrollment period for either Medicaid or CHIP. If you qualify, your coverage can start immediately.

Attributions

This chapter contains content from the following sources in the text, figures, and learning activities:

(1) “Personal Finance: Chapter 10” was adapted by Saylor Academy under a CC BY-NC-SA 3.0 without attribution as requested by the work’s original creator or licensor.

(2) “Introduction to the Law of Property, Estate Planning and Insurance: Chapter 15.1” was adapted by Saylor Academy under a CC BY-NC-SA 3.0 without attribution as requested by the work’s original creator or licensor.

(3) “Using a Flexible Spending Account (FSA)” by HealthCare.gov is in the Public Domain

(4) “What Is Private Mortgage Insurance?” by Consumer Financial Protection Bureau is in the Public Domain

(5) “What is Medicare?” by Medicare.gov is in the Public Domain

(6) “Medicaid” by Medicaid.gov is in the Public Domain

(7) “Children’s Health Insurance Program (CHIP)” by Medicaid.gov is in the Public Domain

Further Readings & References

The following citations are for resources linked in the text and learning activities, and/or recommended by the author for further reading.

Boyte-White, C. (2023, October 18). What are the maximum social security disability benefits? Investopedia name. https://www.investopedia.com/ask/answers/082015/what-are-maximum-social-security-disability-benefits.asp

Connett, W. (2023, October 27). Social security explained: How it works, types of benefits. Investopedia. https://www.investopedia.com/terms/s/socialsecurity.asp

Charaba, C. (2023, December 19). Common types of health insurance plans. PeopleKeep. https://www.peoplekeep.com/blog/common-types-of-health-insurance-plans

Fontinelle, A. (2023, September 21). Life insurance: What it is, how it works, and how to buy a policy. Investopedia. https://www.investopedia.com/terms/l/lifeinsurance.asp

Kagan, J. (2023, April 20). Insurance: Definition, how it works, and main types of policies. Investopedia. https://www.investopedia.com/terms/i/insurance.asp

Kagan, J. (2023, July 23). Mortgage insurance: What it is, how it works, types. Investopedia. https://www.investopedia.com/terms/m/mortgage-insurance.asp

Kagan, J. (2023, December 16). Coinsurance: Definition, how it works, and Example. Investopedia. https://www.investopedia.com/terms/c/coinsurance.asp

Kagan, J. (2023, December 16). Health insurance: Definition, how it works. Investopedia. https://www.investopedia.com/terms/h/healthinsurance.asp

Ross, S. (2021, July 28). How do insurance companies make money? Business model explained. Investopedia. https://www.investopedia.com/ask/answers/052015/what-main-business-model-insurance-companies.asp