3. Making Your Savings Decisions

Learning Objectives

- Describe and employ different money market accounts to meet personal saving goals.

- Define income tax and describe helpful tax planning strategies.

- Recognize the benefits and options of retirement planning at an early age.

Why Should You Save Money?

In short, it allows you to enjoy greater security in your life. In this chapter, we will take a look at savings. Why save? When to save? How to save? These are all critical questions, especially if you want to be financially secure in retirement.

Death and taxes are two certainties in life. While we cannot avoid death, we can take steps to minimize our tax liability. In this learning unit, we will also discuss the basics of taxes, how to determine your tax liabilities, and how to reduce, eliminate, or defer your income taxes legally.

In the previous chapter, we talked about developing a budget. When you have a budget surplus, you gain some flexibility with your funds. You can increase your spending, savings, or investment. In this chapter, we will look at savings in more depth, focusing on retirement savings.

Retirement is when you stop selling your labor, and your primary source of income changes from earned income to retirement benefits, personal savings and investments, and Social Security. It is never too early to start planning for retirement so that you can enjoy your golden years without financial worry.

Five Benefits of Savings[1]

-

It helps in emergencies (e.g., car repair expenses).

-

It cushions against sudden job loss.

-

It helps finance big-ticket purchases (e.g., a new car or a first house) and major life events (e.g., going to college or starting a family).

-

It limits the amount of debt incurred.

-

It helps prepare for retirement.

What Should You Save For?

Savings Rate

The savings rate measures savings over the period in comparison to disposable income.

Savings Rate Formula

For any given period of time:

Savings Rate Example

Savings Instruments

There are many different ways to save your money until you use it. The primary difference is the level of liquidity. Liquidity refers to how easy it is to turn an asset into cash without losing value.[2]

Table 7: Comparison of Savings Instruments

| Low | High | |

| Liquidity | CDs | Checking, Savings, MMMFs |

| Risk Level | Checking, Savings, CDs | MMMFs |

| Interest Earned | Checking, Savings | MMMFs, CDs |

When Should You Start Saving Money?

The answer is now! The earlier you start saving, the more quickly your money can grow.

How does your money earn money over time?

Money earns money through the magic of compounding. Compounding is the process of earning interest on interest. Watch the video [1:27] to learn more.[3]

Two Types of Interest

There are two types of interest:

Time To Practice: Simple And Compound Interest

Compounding Periods

Interest can be compounded annually, semi-annually, quarterly, monthly, daily, or on any other basis.[4] This occurs when the interest is added to the existing balance and the interest begins to earn additional interest.

Table 8: Compounding Periods

| Compounding Periods | n |

| Annually | 1 |

| Quarterly | 4 |

| Monthly | 12 |

| Daily | 365 |

If you have an account that pays 12% interest per year, do you receive a single 12% interest payment each year?

-

Maybe, maybe not.

-

What if you are paid quarterly? You would get four 3% interest payments.

-

What if you receive interest once per month?

-

What if you receive interest daily?

Interest per period = annual interest rate/frequency

Table 9 shows the interest paid per period if the annual interest rate is 12%.

Table 9: Interest Paid per Period (12% rate)

| Compounding Periods | r/n |

| Annually | 12 ÷ 1 = 12% |

| Quarterly | 12 ÷ 4 = 3% |

| Monthly | 12 ÷ 12 = 1% |

| Daily | 12 ÷ 365 = .033% |

Rule of 70

The Rule of 70 is a mathematical rule of thumb that can be applied to the growth rate of anything.

Time to double =

If you divide the growth rate into 70, you get the approximate amount of time it takes for that thing to double in size. For example, to double $1,000 at a 10% annual interest rate, you will need about 70 ÷ 10 = 7 years.

Example of the Rule of 70

Mel has $500 in an account that pays 3.5% interest annually. Use the Rule of 70 to approximate how long it will take Mel to have $1,000, $2,000, and $4,000, respectively.

-

From $500 to $1,000?

-

From $1,000 to $2,000?

-

It takes Mel about 40 years to grow the money from $500 to $2,000.

Why Pay Taxes?

Taxes are mandatory contributions levied on individuals or corporations by a government entity—whether local, regional, or national.[5] Taxes provide revenue for governments to fund essential services—national defense, highways, police, a justice system—that benefit all citizens. Taxes also fund programs and services that benefit only certain citizens, such as Medicare, job training, schools, and parks.[6]

Types of Taxes

To learn more, refer to your textbook, Personal Finance: Chapter 6.1 , or view the article, Types of Taxes.

Income Taxes

Most individuals pay federal, state, and local income taxes.

Federal Taxes

The Internal Revenue Service (IRS) administers the federal tax system. The tax year for federal income tax ends on Dec. 31. If you earn income, you must file a Form 1040, 1040A, or 1040EZ to determine your tax liability by April 15 of each year.

Additional information on federal taxes is available by viewing these resources.

-

To learn more about IRS 1040 form, view What Is an IRS 1040 Form?

- To learn how to file your 1040 form, visit the IRS webpage, How to File

- To estimate your tax liability and tax refund, if applicable, visit TurboTax

- Watch this video from the IRS on How to Pay Your Taxes [1:51 minutes]

States Taxes

As of 2022, Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming are the only states that do not have a state individual income tax.[7]

Local Taxes

About a third of all states allow their counties, municipalities, and other local jurisdictions to impose an income tax. Tax rates are often lower than at the federal or state levels.

As of 2022, states with local income taxes are Alabama, Colorado, Delaware, Indiana, Iowa, Kansas, Kentucky, Maryland, Michigan, Missouri, New Jersey, New York, Ohio, Oregon, Pennsylvania, and West Virginia.[8]

Tax Liability

Progressive Tax

Income tax is usually a progressive tax. The higher the taxable income, the greater the tax rate. Those income categories are called tax brackets.

There are seven federal income tax brackets for the 2023-2024 season: 10%, 12%, 22%, 24%, 32%, 35%, and 37%. Your filing status (single, married filing separately, married filing jointly, etc.) and taxable income determine your bracket.

Table 10: Income Tax Brackets in 2023 (Single Filing Status)[9]

| If taxable income is | The tax due is |

| Not over $11,000 | 10% of taxable income |

| Over $11,000 but not over $44,725 | $1,100 plus 12% of the excess over $11,000 |

| Over $44,725 but not over $95,375 | $5,147 plus 22% of the excess over $44,725 |

| Over $95,375 but not over $182,100 | $16,290 plus 24% of the excess over $95,375 |

| Over $182,100 but not over $231,250 | $37,104 plus 32% of the excess over $182,100 |

| Over $231,250 but not over $578,250 | $52,832 plus 35% of the excess over $231,250 |

| Over $578,125 | $174,238 plus 37% of the excess over $578,125 |

Determine Your Preliminary Tax Liability

-

Determine filing status (i.e., single, married filing separately, married filing jointly, etc.)

-

Refer to the appropriate tax brackets and find your tax on base and tax rate.

-

Apply the formula: Preliminary tax liability = Tax on base + Tax rate on excess × (Taxable income − Base)

Example—Determine Billy’s Preliminary Tax Liability

-

Billy’s filing status = Single and his taxable income = $31,000.

-

Using the table above, his taxable income falls into the second tax bracket: tax on base = $1,100 and tax rate on excess = 12%

-

Preliminary tax liability = $1,100 plus 12% of the excess over $11,000

$1,100 + 12% × ($31,000−$11,000) =

$1,100 + $2,400 = $3,500

Billy’s tax liability: he owes $3,500 in taxes

Time to Practice: Preliminary Tax Liability

Let’s help Alice determine her preliminary tax liability. Alice’s taxable income is $54,725.

She is married filing separately. Here are the relevant tax brackets for her filing:

Table 11: 2023 Married Filing Separately Tax Brackets[10]

| If taxable income is | The tax due is |

| Not over $11,000 | 10% of taxable income |

| Over $11,000 but not over $44,725 | $1,100 plus 12% of the excess over $11,000 |

| Over $44,725 but not over $95,375 | $5,147 plus 22% of the excess over $44,725 |

Using the information provided above, help Alice figure out her preliminary tax liability.

Income Tax Planning

There is no obligation to pay any more in taxes than legally required. Tax planning seeks legal ways to reduce, eliminate, or defer income taxes. To achieve this goal, you can 1) reduce taxable income, 2) apply for tax credit, or combine these two.

Reducing Taxable Income

Your income tax is calculated based on your taxable income. Reducing your taxable income, not your total income, is the key to paying less income tax.

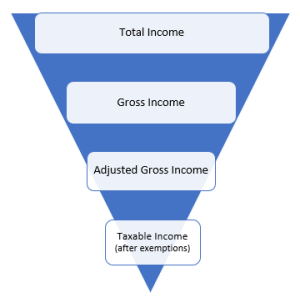

We must differentiate between total income, gross income, adjusted gross income, and taxable income.

Deductions

Deductions: Standard deduction and itemized deduction. The IRS adjusts the standard deduction for inflation for each tax year.

Table 12: Standard Deduction Amounts for 2023 Taxes

| Filing Status | Standard Deduction 2023 |

| Single; Married Filing Separately | $13,850 |

| Married Filing Jointly & Surviving Spouses | $27,700 |

| Head of Household | $20,800 |

The standard deduction is the simplest way to reduce your taxable income on your tax return. You simply claim a flat dollar amount determined by the IRS.

Here is what that means: If you earned $75,000 in 2023 and file as a single taxpayer, taking the standard deduction of $13,850 will reduce your taxable income to $61,150. Use the itemized deduction only when it is greater than the standard deduction.

Exemptions

Personal exemptions are based on the number of people supported by the taxpayer’s income—one exemption each for the taxpayer, the spouse, and each dependent child. In 2017, for example, the exemption was $4,050 per person in the household. Personal exemptions have been eliminated beginning after December 31, 2017, and before January 1, 2026.[11]

Reduce Your Preliminary Tax Liability

Final tax liability = Preliminary tax liability − Tax credits

Examples of tax credits are:

-

Health insurance premium tax credit

-

Hope scholarship credit

-

Section 529 college saving plan

-

Child tax credit

-

Retirement savings contribution credit

-

Mortgage interest credit

Six Steps To Calculate Your Final Tax Liability

Strategies To Reduce Income Taxes

Reduce taxable income through your employer.

-

Premium health insurance plan

-

Transportation reimbursement plan

-

Flexible Spending Account (FSA)

-

401(k) retirement plan—Contribute to your employer-sponsored 401(k) plan at least up to the employer’s matching contribution amount.

Make tax-sheltered investments.[12]

A tax shelter is a place to legally store assets so that current tax liabilities are minimized. A tax shelter may permanently reduce the tax amount or simply defer the taxes owed to a future period. Returns of tax-sheltered investments are tax-advantaged.

Examples of tax-sheltered investments:

-

Traditional IRA

-

Section 529 college saving plan

-

Government savings bonds

-

Capital gains on housing

How Tax Planning Fits Within Your Financial Plan

Ask yourself the following questions:

-

What tax savings are currently available to me?

-

How can I increase my tax savings in the future?

-

Should I increase or decrease the amount of my withholding?

-

What records should I keep?

Table 13: Financial Plan Example

| Tax liability (based on applying tax rates to the taxable income) | $3,693.75 | $2,868.75 |

| Category | Current Situation | Long-Term Plan |

| Gross Income | $38,000 | $38,000 |

| − IRA Contribution | $0 | $5,000 |

| = Adjusted Gross Income | $38,000 | $33,000 |

| − Deductions | $6,300 | $6,800 |

| − Exemptions | $4,000 | $4,000 |

| = Taxable income | $27,700 | $22,200 |

Then revise your financial plan.

Approximate Total Tax Savings = $825.00 per year

Why Should You Start Saving for Retirement Early? The Magic of Compounding

Why Should You Start Saving for Retirement Early? To Reduce or Defer Income Tax

We’ll look at two options to reduce or defer income tax: employer-sponsored retirement plans and individual retirement accounts (IRAs).

Employer-Sponsored Retirement Plans

Examples of employer-sponsored retirement plans that we’ll explore include:

-

401(k) plan:

-

Traditional 401(k)

-

Roth 401(k)

-

-

403(b) plan

-

Simplified Employee Plan (SEP)

-

Savings Incentive Match Plan for Employees(SIMPLE) Plan

-

457 plan. Visit 457 Plan to learn more.

Retirement Plans for the Self-Employed

Examples of retirement plans for the self-employed that we’ll explore include:

-

Keogh Plan: contribution from pre-tax income. To learn more about the Keogh Plan, read Keogh Plan: Definition Types, Advantages & Disadvantages .

-

Individual Retirement Account (IRA)

-

Traditional IRA

-

Roth IRA

-

Simplified Employee Plan (SEP) IRA. To learn more about the SEP, read Simplified Employee Pension (SEP) IRA: What It Is, How It Works

How Much Do You Need To Retire?

Key Takeaways

-

Project your taxable income and total withholding for this year.

-

Sign up for tax-advantaged employee benefits at your workplace.

-

You are never too young to start saving money.

-

Save for emergency fund first: Start with a $1,000 goal and save until you have a fully funded emergency fund to cover 3–6 months of essential expenses.

-

The higher the number of compounding periods, the greater the amount of compound interest.

-

Depending on your income, you can contribute to your employer-sponsored retirement plan and an IRA.

Attributions

This chapter contains content from the following sources in the text and learning activities:

(1) Personal Finance was adapted by Saylor Academy under a CC BY-NC-SA 3.0 without attribution as requested by the work’s original creator or licensor.

(2) “ The Math of Money ” by J. Zachary Klingensmith, OER Commons, is licensed under CC BY-NC-SA 4.0

Further Reading & References

The following citations are for further readings linked in the text and learning activities. Footnotes below are for additional references paraphrased or quoted in the chapter content.

Ameriprise Financial Services. (n.d.). How does a 401(k) plan work? Retrieved December 5, 2023 from https://www.ameriprise.com/financial-goals-priorities/retirement/what-is-a-401k#:~:text=A%20401(k)%20is%20an,and%20invested%20in%20their%20account

EconEdLink. (n.d.). Compound interest calculator. https://www.econedlink.org/resources/compound-interest-calculator/

Fay, B. (2023, November 30). Types of taxes. Debt.org. Retrieved December 11, 2023 from https://www.debt.org/tax/type/

Fernando, J. (2023, March 19). What is a 401(k) and how does it work? Investopedia. Retrieved December 5, 2023 from https://www.investopedia.com/terms/1/401kplan.asp

Internal Revenue Service. (2023, May 23). How to file. https://www.irs.gov/filing/individuals/how-to-file

Internal Revenue Service. (2023, August 29). Individual retirement arrangements (IRAs). https://www.irs.gov/retirement-plans/individual-retirement-arrangements-iras

Internal Revenue Service. (2022, November 21). Taxpayers should review the 401(k) and IRA limit increases for 2023. https://www.irs.gov/newsroom/taxpayers-should-review-the-401k-and-ira-limit-increases-for-2023#:~:text=The%20amount%20individuals%20can%20contribute,also%20all%20increase%20for%202023

The Investopedia Team. (2023, January 23). 403(b): What it is, how it works, 2 main types. Investopedia. Retrieved December 11, 2023 from https://www.investopedia.com/terms/1/403bplan.asp

The Investopedia Team. (2023, December 10). Individual retirement account (IRA): What it is, 4 types. Investopedia. Retrieved December 11, 2023 from https://www.investopedia.com/terms/i/ira.asp

The Investopedia Team. (2023, July 27). Simplified employee pension (SEP) IRA: What it is, how it works. Investopedia. Retrieved December 11, 2023 from https://www.investopedia.com/terms/s/sep.asp

IRSvideos. (2022, April 14). How to pay your taxes [Video]. YouTube. https://www.youtube.com/watch?v=bZjTIHPyY94

Kagan, J. (2023, May 7). Keogh plan: Definition types, advantages & disadvantages. Investopedia. Retrieved July 5, 2023 from https://www.investopedia.com/terms/k/keoghplan.asp

Liberto, D. (2023, November 19). 457 plan. Investopedia. Retrieved December 11, 2023 from https://www.investopedia.com/terms/1/457plan.asp

Nerdwallet. (20232). Compound interest calculator. https://www.nerdwallet.com/calculator/compound-interest-calculator

Research Department, Federal Reserve Bank of St. Louis. (2023, November 30). Personal saving rate [PSAVERT]. Federal Reserve Economic Data (FRED). Retrieved July 5, 2023, from https://fred.stlouisfed.org/series/PSAVERT

Taxcaster: Tax calculator 2023. (n.d.) IntuitTurboTax. https://turbotax.intuit.com/tax-tools/calculators/taxcaster/

What is an IRS 1040 form? (2023, April 26). IntuitTurboTax. https://turbotax.intuit.com/tax-tips/irs-tax-return/what-is-an-irs-1040-form/L4aOys6cI

Waters, C. (2023, April 27). American are saving far less than normal in 2023. Here’s why. CNBC. Retrieved July 5, 2023 from https://www.cnbc.com/2023/04/27/us-personal-savings-rate-falls-near-record-low-as-consumers-spend.html

- CHN Financial Consultancy. (2023). 5 benefits of saving money. https://www.chnfc.co.uk/5-benefits-of-saving-money ↵

- Capital One. (2022, July 26). What is liquidity and why does it matter? https://www.capitalone.com/learn-grow/money-management/liquidity/ ↵

- One Minute Economics. (2016, November 26). Compound interest explained in one minute [Video]. YouTube. https://www.youtube.com/watch?v=jTW777ENc3c ↵

- Fernando, J. (2023, May 18). The power of compound interest: Calculations and examples. Investopedia. https://www.investopedia.com/terms/c/compoundinterest.asp ↵

- Gorton, D. (2023, March 31). Taxes definition: Types, who pays, and why. Investopedia. https://www.investopedia.com/terms/t/taxes.asp ↵

- Internal Revenue Service. (n.d.) Understanding taxes: The whys of taxes: Theme 1, your role as a taxpayer: Lesson 1, why pay taxes? [Sample lesson plan]. Retrieved December 11, 2023 from https://apps.irs.gov/app/understandingTaxes/teacher/whys_thm01_les01.jsp#:~:text=Taxes%20provide%20revenue%20for%20federal,services%20very%20effectively%20for%20themselves ↵

- Vermeer, T. (2023, February 21). State individual income tax rates and brackets for 2023. Tax Foundation. https://taxfoundation.org/publications/state-individual-income-tax-rates-and-brackets/ ↵

- Moreno, T. (2023, January 5). States with local income taxes. The Balance. Retrieved December 11, 2023 from https://www.thebalancemoney.com/cities-that-levy-income-taxes-3193246 ↵

- Washington, K. (2023, July 3). 2022-2023 tax brackets & federal income tax rates. Forbes Advisor. Retrieved July 5, 2023 from https://www.forbes.com/advisor/taxes/taxes-federal-income-tax-bracket/ ↵

- Washington, K. (2023, July 3). 2022-2023 tax brackets & federal income tax rates. Forbes Advisor. Retrieved July 5, 2023 from https://www.forbes.com/advisor/taxes/taxes-federal-income-tax-bracket/ ↵

- Internal Revenue Service. (2023, October 23). Tax reform provisions that affect individuals. Individuals webpage. https://www.irs.gov/newsroom/individuals#:~:text=Personal%20Exemption%20Deduction%20Eliminated,Reform%20Tax%20Tip%202019%2D35 ↵

- Kagan, J. (2023, March 2). Tax shelter: Definition, examples, and legal issues. Investopedia. Retrieved July 5, 2023 from https://www.investopedia.com/terms/t/taxshelter.asp ↵

- The Motley Fool. (2019, October 2). How much do I need to retire? Retirement planning 101 [Video]. YouTube. https://www.youtube.com/watch?v=O3nkFyTNtjw ↵