4. Making Your Borrowing Decisions

Learning Objectives

- Indicate what a loan is, and different types of loans.

- Describe how a credit card works.

- Explain the impact of credit on loans.

To Borrow Or Not Borrow?

Borrowing can be a risky and costly proposition. However, it can be a powerful tool for achieving your financial goals when used wisely. The concept of credit is simple: you borrow money from a lender today, with the promise to repay it later, plus interest. The lender’s decision to extend your credit is based on their assessment of your creditworthiness. This assessment considers your income, debt-to-income ratio, and payment history.

You can borrow money at lower interest rates with a good credit score. This can save you a significant amount of money over the long term. There are many types of credit, including credit cards, student loans, and mortgages. Each type of credit has its benefits and drawbacks. Understanding the different kinds of credit before you start borrowing is essential.

This chapter aims to empower you with the skills to manage your credit successfully, such as building a credit history in early adulthood, reading your credit report, and improving your credit score. It also explores using credit responsibly and establishing a personal debt limit.

Loans

A loan is a form of debt where one party agrees to lend money to another with an agreement to pay it back.

Debt is the total amount of money you owe to another party. Debt covers any amount owed to another, whereas a loan refers to an agreement where one party lends to another. (e.g., assume you have a student loan and an auto loan. Your debt is the sum of these two loans).[1]

Components of a Loan

When discussing loans, it is essential to recognize the components of typical loans.

Principal

This is the original amount of money that is being borrowed.

Loan Term (or repayment period)

The amount of time the borrower has to repay the loan.

Interest Rate

The rate at which the amount of money owed increases, usually expressed in terms of an annual percentage rate (APR).

Loan Payments

The amount of money that must be paid every month or week to satisfy the loan terms.

Types of Loans

Loans fall into two categories: unsecured and secured.

Unsecured loan

Requires no collateral. These usually have higher interest rates than secured loans because they are riskier for lenders (e.g., personal loans).

Secured loan

Uses an asset you own as collateral; the lender can take the asset if you do not repay the loan (e.g., auto loan, mortgage, home equity loan).

Credit

Credit comes from the Latin verb credere, which means “to believe.” In finance, it refers to the ability to borrow money now and repay it later. There are two main types of credit:

Revolving Credit

Credit where you can borrow up to a specified maximum amount and repay what you borrow as you use it. Examples of revolving credit include credit cards and lines of credit.

Installment Credit

Loan where you receive the money you borrow in a single lump sum and then repay it in pre-determined monthly installments. Examples of installment credit include car loans, mortgages, and student loans.

For more information, read Revolving credit vs. installment credit: What’s the difference?.

Table 14: Revolving Credit vs. Installment Credit

Credit Bureaus

Credit bureaus collect information about your credit history and create credit reports. This information includes your credit accounts, payment history, and credit inquiries. Lenders use credit reports to assess your creditworthiness, which determines how likely you are to repay a loan.

The three major credit bureaus in the United States are Equifax, Experian, and TransUnion. By law, you can receive a free credit report from each of these bureaus once per year.

AnnualCreditReport.com is the only website authorized by the federal government to issue free annual credit reports.

Credit Reports

It is important to check your credit reports regularly to ensure accurate information. If you find any errors, you should dispute them with the credit bureaus. You can also use your credit reports to track your credit score, which is a number that lenders use to assess your creditworthiness.

Here are some tips for using your free credit reports wisely:

- Request a report from each of the three credit bureaus every four months. This will allow you to see how your credit report looks from different perspectives.

- Review your credit reports carefully for any errors. If you find any errors, dispute them with the credit bureaus immediately.

- Track your credit score over time to see how it is changing. This will help you identify areas where you need to improve your credit.

What Information Is On Your Credit Report?

- Report number, date, and name

- Identifying information (name, birth date, SSN, etc.)

- Bill payment history

- Loans

- Current debt

- Bankruptcy history

- Lawsuit records

In most cases, your credit report will not include your credit score.

Who Uses Credit Reports And Why?

Credit bureaus can sell the information on your credit report to:

- Lenders

- Potential employers

- Insurance companies

- Rental property owners

These businesses may use the information on your credit report to decide if you qualify for credit, loans, rental property leases, employment, and insurance.

Credit Scores

A credit score is a number that lenders use to assess your creditworthiness, determining how likely you are to repay a loan. Credit scores are based on information in your credit report, which includes your credit accounts, your payment history, and your credit inquiries.

Types of Credit Scores

There are two main types of credit scores: FICO scores and VantageScores. FICO and VantageScore create credit scores using information from your credit reports.

FICO scores are more widely used by lenders than VantageScores. However, FICO scores and VantageScores are important factors in determining your creditworthiness.

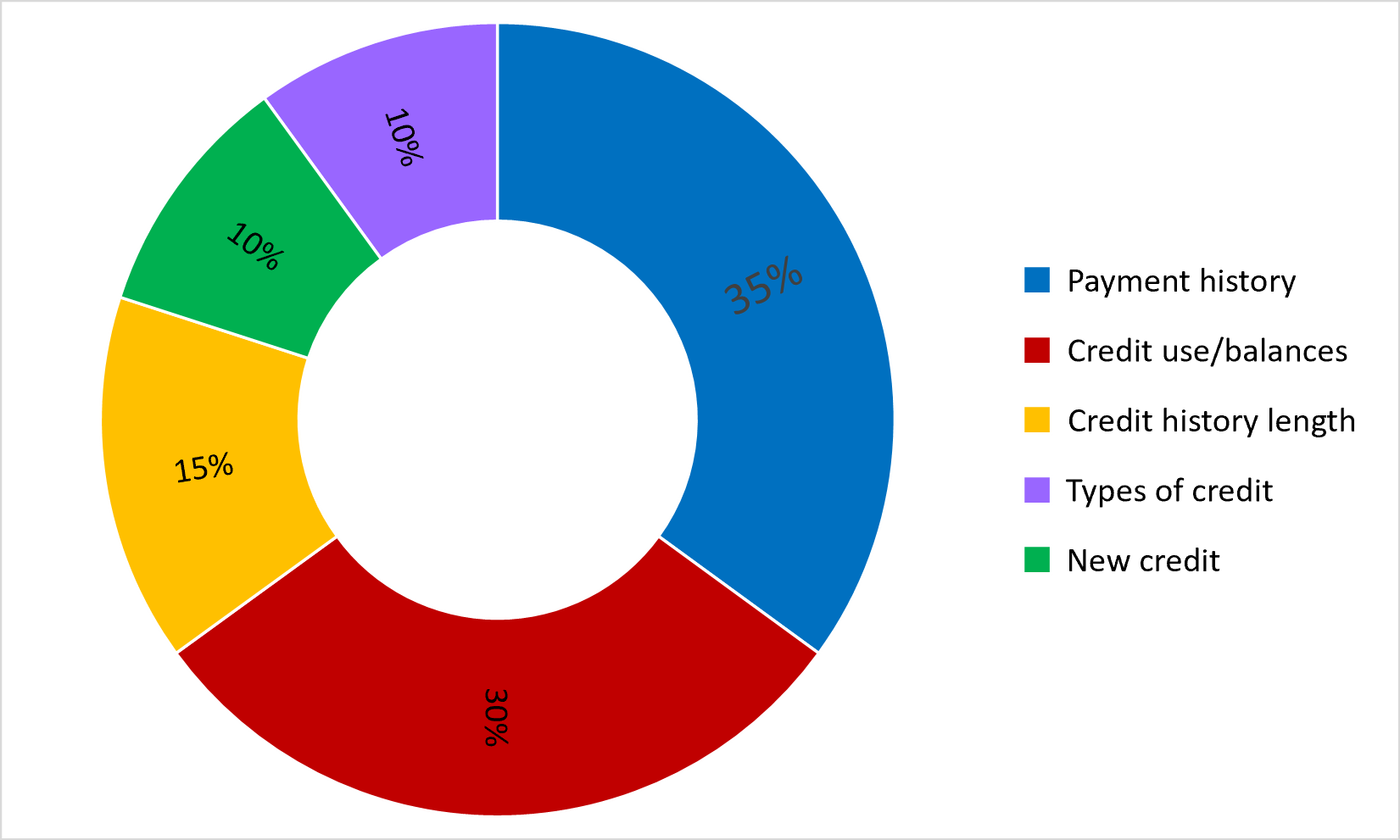

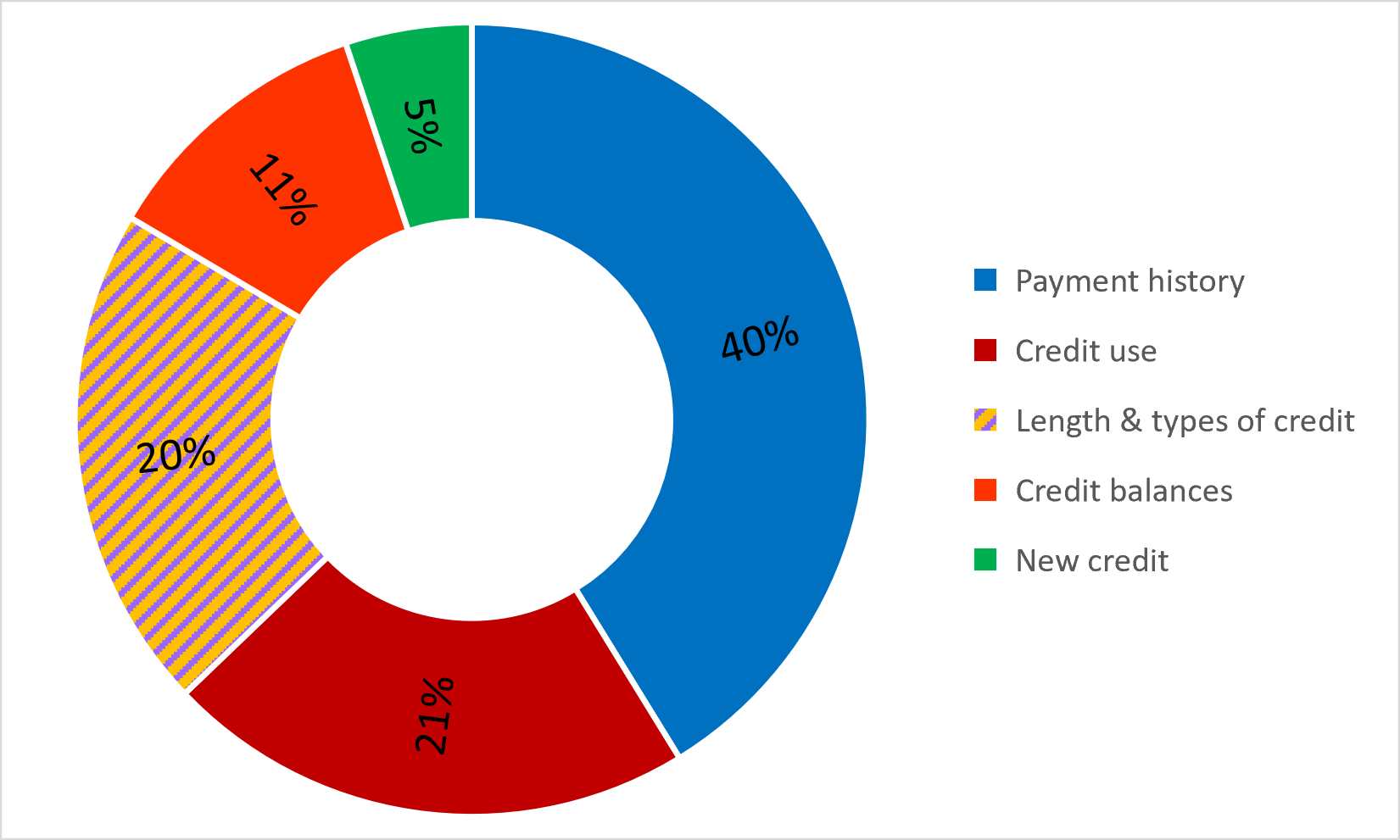

Both FICO scores and VantageScores use similar factors to calculate your credit score:

Main Factors in a FICO Score

Main Factors in a Vantage Score

For more information, read VantageScore vs. FICO score: The biggest differences between your VantageScore and FICO ratings.

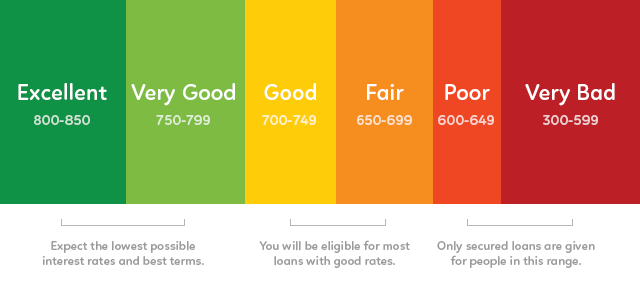

Interpreting Credit Scores

Both FICO scores and VantageScores range from 300 to 850, and each divides the ranges into five categories. A higher credit score means that you are a lower-risk borrower.

For more information on credit scores and reports, watch Credit Scores and Reports 101 [4:04 minutes].

Your Credit Score

There are four main ways to obtain your credit score:

- Check your credit or loan statements.

- Talk to a credit or housing counselor.

- Use a credit score service (e.g., Credit Karma).

- Buy your score from one of the three major credit reporting agencies: Equifax, Experian, or TransUnion.

How Your Credit Score Impacts Your Financial Future

Each individual has their own credit score—this includes you! Lenders use it to decide whether you get a mortgage, a credit card (or some other line of credit), and the interest rate you are charged for this credit.

The score provides a picture of you as a credit risk to the lender at the time of your application.

- A lower score implies a riskier borrower.

- A higher score implies a less risky borrower.

Your credit score is a reflection of your credit risk to lenders. The lower your score, the riskier you appear to be, and the less likely you are to get credit; or, if you are approved, you will pay more to borrow money. Lenders will look into your credit history in more detail if you are trying to borrow money. They could deny your application or offer higher interest rates if you have had a previous negative remark, such as a foreclosure, or if you owe a debt to collection agencies.

Ways To Improve Your Credit Score

Here are some ways to improve your credit score:

Credit Cards

A credit card is a revolving line of credit that allows you to borrow money up to a pre-set limit. You can use a credit card to pay for your living expenses, but you must make at least the minimum payment each month. If you do not pay the entire balance by the end of the grace period, you will be charged interest on the unpaid balance. Credit cards may also charge annual fees and late payment fees.

Characteristics of Credit Cards

Advantages and Disadvantages of Using Credit Cards

It is important to be aware of the advantages and disadvantages of using credit cards before applying for one. Using your card responsibly can be a valuable tool for building your credit score and managing your finances. However, if you are not careful, it can also lead to financial problems.

Types of Credit Cards

There are two main types of credit cards: bank credit cards and store credit cards.

Bank-issued credit cards

Banks, credit unions, or other financial institutions issue bank credit cards. They can be used anywhere that accepts the card’s network, such as MasterCard, Visa, Discover, or American Express.

Store-issued credit cards

Retailers can issue credit cards that can only be used at the retailer who issued the card. For example, a department store or gas station credit card can only be used at that store or gas station (e.g., Target RedCard, Shell Card).

FYI: Some large retailers also offer co-branded major Visa or Mastercard credit cards that can be used anywhere, not just in the retailer’s stores. For example, the Walmart Mastercard can be used at Walmart and anywhere else that accepts Mastercard.

Credit Cards With Rewards for Everyday Purchases

A rewards credit card offers customers travel rewards and other perks with everyday purchases. There are many credit cards available with rewards programs available.

Travel credit cards offer rewards like points or miles that can be redeemed for flights, hotel stays, and other travel expenses. These cards often have annual fees but can be worth it if you travel frequently. To learn more, read How Do Travel Credit Cards Work?

Entertainment credit cards offer rewards for spending on entertainment, such as movies, concerts, and sporting events. These cards often have lower annual fees than travel cards but may offer fewer rewards.

Factors to Consider When Choosing a Credit Card

Credit Card Payments

Minimum payments are the smallest amount you can pay on your monthly credit card bill without incurring late fees or other penalties. However, even if you pay the minimum, you will still be charged interest on your outstanding balance. The amount of your minimum payment will vary depending on your credit card issuer and your credit card agreement. You can find your minimum payment on your monthly credit card statement.

What Is a Minimum Payment?

Compounding interest can work wonders for your savings, but it can also work against you if you are carrying credit card debt. When you only make the minimum payment on your credit card, you are essentially paying interest on your debt and draw on your interest. This can quickly snowball your debt and make it much harder to pay off.

How to Use Your Credit Cards Responsibly

Here are some tips on how to use your credit cards responsibly:

- Limit the number of credit cards you have

- Having too many credit cards can make it challenging to track your spending and lead to overspending.

- Pay your credit card balance in full each month

- This is the best way to avoid paying interest on your purchases.

- Be aware of your APR and all fees

- This information is typically found on your credit card statement.

- Limit cash withdrawals

- Cash withdrawals typically have high finance charges, so it’s best to avoid them if possible.

- Read your credit card statement carefully

- This is important to ensure there are no errors and to dispute any charges you do not recognize.

- Pay attention to your credit utilization

- Your credit utilization is the percentage of your credit limit that you are using. Keeping your credit utilization low is important, as this can impact your credit score.

By following these tips, you can use your credit cards responsibly and improve your financial health.

To learn more about your credit card statement, visit Understand Your Credit Card Statement.

To learn more about credit cards, how to avoid common credit card mistakes, and how to use your credit card in the best way possible, watch Credit Cards: Mistakes and Best Practices [2:28][2]

When To Borrow

Borrowing can be costly, but it is not always a bad thing.

Sometimes, you must borrow because you need money to fund your purchase. For example, if you want to buy a house, you may need to borrow money from a bank.

Other times, you can choose between your own money and other people’s money. For example, if you want to buy a new car, you could save up for it and pay cash or take out a loan and finance the purchase.

The decision of whether or not to borrow depends on the specific situation. If borrowing makes you better off financially, it may be the right decision. However, if borrowing will only make you worse off, then it is best to avoid it.

Reason 1

Using your own money is not free.

Reason 2

Because you can have the asset sooner rather than later.

Example 1: Taking Out a Mortgage to Purchase a Home

You can borrow money to purchase a home in your early 30s versus saving enough to purchase a home in your later 60s.

Example 2: Taking Out Student Loans to Attend College

Education is a valuable investment that can increase your potential earnings. If you do not go to college, you will likely start working immediately. However, the opportunity cost of going to college is the foregone earnings that you would have made if you had started working instead. Therefore, starting college as soon as possible is important when the opportunity cost is lowest. This will give you the most time to benefit from the increased income you will earn after graduation.

Debt-to-Income Ratio

In addition to your credit score, your debt-to-income (DTI) ratio is an important measure of your overall financial health. Calculating your DTI can help you determine how comfortable you are with your current debt load and whether you are at risk of overextending yourself financially. Lenders also use your DTI ratio to assess your ability to repay a loan, so keeping it in a healthy range is important.

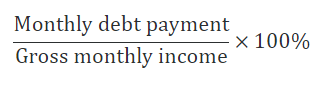

How Do I Calculate My DTI Ratio?

There are three steps you can complete to calculate your debt-to-income (DTI) ratio.

Step 1

Add up your monthly bills, which may include:

- Monthly rent or house payment

- Monthly alimony or child support payments

- Student, auto, and other monthly loan payments

- Credit card monthly payments (use the minimum payment)

- Other debts

Note: Expenses like groceries, utilities, gas, and your taxes generally are not included

Step 2

Divide the total by your gross monthly income, which is your income before taxes and deductions.

Step 3

The result is your DTI, which will be in the form of a percentage. The lower the DTI, the less risky you are to lenders.

For example, if you pay $1,500 a month for your mortgage, $100 a month for an auto loan, and $400 a month for the rest of your debts, your monthly debt payments are $2,000 ($1500 + $100 + $400 = $2,000). If your gross monthly income is $6,000, your DTI ratio is 33% (= 100% × $2,000 / $6,000).

How Good Is Your DTI?

Key Takeaways

Tips for Building Good Credit:

- Get your free credit report each year

- You can get a free credit report from each of the three major credit bureaus once per year at AnnualCreditReport.com. This is a valuable tool for checking your credit report for errors and to see how your credit score is calculated.

- Use credit cards responsibly

- Credit cards can help establish your credit score, which will be important later on. However, using credit cards responsibly and paying your bills on time is important.

- Avoid the credit card minimum payment trap

- The minimum payment on your credit card bill is the smallest amount you can pay without incurring late fees or other penalties. However, even if you pay the minimum, you will still be charged interest on your outstanding balance. The best way to avoid paying interest on your credit card purchases is to pay your bill in full each month.

- Payment history is the most important factor to your credit score

- Your payment history makes up a large part of your credit score. This means that it is essential to pay your bills on time, every time.

- Borrow when it makes you better off

- There are times when borrowing money can make sense, such as when you are buying a house or a car. However, it is important only to borrow money when you can afford the payments and when the borrowing will actually improve your financial situation.

- Keep your debt-to-income ratio below 36%

- Your debt-to-income ratio is the percentage of your monthly income that goes towards debt payments. A high debt-to-income ratio can make qualifying for loans difficult and damage your credit score.

Following these tips can improve your credit score and build a solid financial foundation.

Attributions

This chapter contains content from the following sources in the text and learning activities:

(1) “ Loan ” by the Legal Information Institute at Cornell University is licensed under CC BY-NC-SA 2.5

(2) “ Personal Finance: Chapter 7.3 “was adapted by Saylor Academy under a CC BY-NC-SA 3.0 without attribution as requested by the work’s original creator or licensor.

(3) “ Learn about your credit report and how to get a copy ” by USA.gov is in the Public Domain

(4) “ Understand, get, and improve your credit score ” by USA.gov is in the Public Domain

(5) “ Personal Finance: Chapter 2.3 “was adapted by Saylor Academy under a CC BY-NC-SA 3.0 without attribution as requested by the work’s original creator or licensor.

Further Readings & References

The following citations are for further readings, either linked in the text and learning activities or recommended by the author. Footnotes below are for additional references paraphrased or quoted in the chapter content.

Akin, J. (2021, May 13). Home equity loan vs. HELOC: What is the difference? Experian. https://www.experian.com/blogs/ask-experian/home-equity-loan-vs-home-equity-line-of-credit/

Axelton, K. (2021, October 13). 8 different types of loans you should know. Experian. https://www.experian.com/blogs/ask-experian/types-of-loans/

Bareham, H., & Bingler, L. (2023, June 5). How to apply for a credit card and get approved. Bankrate. https://www.bankrate.com/finance/credit-cards/how-to-apply-for-a-credit-card/

Bloomenthal, A. (2023, May 6). Credit card: What it is, how it works, and how to get one. Investopedia. https://www.investopedia.com/terms/c/creditcard.asp

Cain, S. (2023, September 19). Which credit score do mortgage lenders use? Time. https://time.com/personal-finance/article/which-credit-score-do-mortgage-lenders-use/

Central Source LLC. (n.d.). Annual Credit Report.com. https://www.annualcreditreport.com/index.action

Consumer Financial Protection Bureau. (2022, June 8). What is a good debt-to-income ratio? https://www.consumerfinance.gov/ask-cfpb/what-is-a-debt-to-income-ratio-en-1791/

DeMatteo, M. (2023, January 18). What is a personal loan and how does it work? CNBC. https://www.cnbc.com/select/what-is-a-personal-loan/

Etzel, N. (2023, January 18). How do travel credit cards work? Nerdwallet. https://www.nerdwallet.com/article/travel/how-do-travel-credit-cards-work

How your credit score impacts your financial future. (n.d.). FINRA. https://www.finra.org/investors/personal-finance/how-your-credit-score-impacts-your-financial-future

Kagan, J. (2023, August 25). Cash advance: Definition, types, and impact on credit score. Investopedia. https://www.investopedia.com/terms/c/cashadvance.asp

Kagan. J. (2023, July 31). What is a loan, how does it work, types and tips on getting one. Investopedia. https://www.investopedia.com/terms/l/loan.asp

Kagan. J. (2023, November 6). What is a mortgage? Types, how they work and examples. Investopedia. https://www.investopedia.com/terms/m/mortgage.asp

Lake, R. (2023, April 26). Personal loan: Definition, types, and how to get one. Investopedia. https://www.investopedia.com/personal-loan-5076027

Luthi, B. (2022, August 3). What is an auto loan? Experian. https://www.experian.com/blogs/ask-experian/what-is-auto-loan

Minimum Payment Calculator. (n.d.). Bankrate. https://www.bankrate.com/finance/credit-cards/minimum-payment-calculator/

Money Coach. (2016, July 16). Credit scores and reports 101 (credit card and loan basics 2/3) [Video]. YouTube. https://www.youtube.com/watch?v=71iaNlskCc0

National Credit Union Administration. (n.d.). Understand your credit card statement. MyCreditUnion.gov. https://mycreditunion.gov/life-events/checking-credit-cards/credit-cards/statement

Rosenberg, E., & Kim, P. (2023. January 19). VantageScore vs. FICO score: The biggest differences between your Vantagescore and FICO ratings. Business Insider. https://www.businessinsider.com/personal-finance/vantagescore-versus-fico-score

Segal, T. (2022, December 21). Education loan: Definition, types, debt strategies. Investopedia. https://www.investopedia.com/terms/e/education-loan.asp

Segal, T. (2023, March 20). Revolving credit vs. installment credit: What’s the difference. Investopedia. https://www.investopedia.com/ask/answers/110614/what-are-differences-between-revolving-credit-and-installment-credit.asp

Wells Fargo. (n.d.). Calculate your debt-to-income ratio. https://www.wellsfargo.com/goals-credit/smarter-credit/credit-101/debt-to-income-ratio/

Wells Fargo. (n.d.). What is a good debt-to-income ratio? https://www.wellsfargo.com/goals-credit/smarter-credit/credit-101/debt-to-income-ratio/understanding-dti/

What is a credit builder loan? (n.d.). Equifax. https://www.equifax.com/personal/education/credit-cards/credit-builder-loan/

What to know about credit card minimum payments. (2023, May 4). Capital One. https://www.capitalone.com/learn-grow/money-management/credit-card-minimum-pay-explained/

- Wex Definitions Team. (2021, September). Loans. Legal Information Institute, Cornell University. https://www.law.cornell.edu/wex/loan ↵

- Money Coach. (2016, July 16). Credit cards: Mistakes and best practices (credit card basics 3/3) [Video]. YouTube. https://www.youtube.com/watch?v=gM0bCqpv3No ↵